In the dynamic realm of financial markets, the Federal Reserve’s balance sheet is a significant influencer, often dictating the tempo for various asset classes, including the S&P 500, Bitcoin, and Gold. These assets respond to the Fed’s monetary policies, and their performance relative to the Fed’s actions can be analyzed through ratios that compare their values to the Fed’s balance sheet size. This analysis is vital for investors, particularly during periods of extensive monetary expansion.

In the dynamic realm of financial markets, the Federal Reserve’s balance sheet is a significant influencer, often dictating the tempo for various asset classes, including the S&P 500, Bitcoin, and Gold. These assets respond to the Fed’s monetary policies, and their performance relative to the Fed’s actions can be analyzed through ratios that compare their values to the Fed’s balance sheet size. This analysis is vital for investors, particularly during periods of extensive monetary expansion.

Average day traders experience fluctuating returns, heavily influenced by individual skills, strategies, and prevailing market conditions, leading to a lack of a consistent success rate. The majority end up unprofitable, underscoring the risks of pursuing gains through short-term market movements.

Hedge funds have demonstrated a five-year Compound Annual Growth Rate (CAGR) of 6.5%, albeit with variable annual performance, as they strive to outdo market norms. Macro-risk-asset funds, which target broad economic trends, show a relatively stable performance, with a five-year Compound Annual Return (CAR) of about 4.2%.

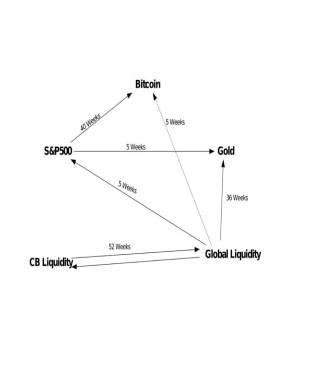

Grasping the nuances of liquidity cycles, central bank strategies, refinance dynamics, and the influence of demographics on regional economic growth is crucial for a deep understanding of the financial landscape. This knowledge equips individuals with the insights needed to analyze market trends beyond the scope of traditional trading and investment strategies.

The adoption of advanced technologies in sectors such as technology, automation, blockchain, and AI is not merely a trend but a strategic necessity to counteract the challenges posed by currency debasement and shifting economic paradigms. These innovations are pivotal in addressing demographic and fiscal restructuring challenges, driving growth in an era where conventional investment avenues often falter under the strain of monetary inflation and demographic shifts.

Investment approaches synchronized with global liquidity trends extend beyond seeking nominal gains, aiming instead for substantial, real-value growth. Such strategies are vital in transcending the prevailing currency debasement, with the potential to secure returns that not only rival but may exceed traditional market benchmarks. This becomes increasingly pertinent as markets navigate the complexities of systemic financial stress and the obscured yet tangible effects of inflation.

Our engagement with technology, initiated by a team of tech aficionados rather than finance veterans, has serendipitously led to the creation of tools and systems that assist in decoding the financial matrix. Through innovations like [D’Fake], [Truth] Serum, [Big] Data, [FIN] Wisdom (encompassing Liquidity and Recession Indicators), [SQ] Artrium, and API, we’ve democratized access to sophisticated analytics, offering these resources either free of charge or at minimal cost. We are committed to expanding this suite of tools to further empower analytical and investment decision-making processes.

In essence, our objective is to democratize financial insight, enabling an informed approach to outpacing both currency debasement and inflation, thereby fostering genuine wealth creation, as manifested by enhanced purchasing power.

What do these Ratios Mean?

The “Fed/Asset Ratio” is a litmus test for measuring the relative growth or decline of an asset’s value against the scale of the Federal Reserve’s balance sheet. A higher ratio points to the Fed’s balance sheet expansion outpacing asset price growth or the asset’s value declining relative to the increasing money supply. Conversely, a lower ratio suggests an asset’s value appreciation outstripping the balance sheet’s growth, or perhaps the Fed’s balance sheet contraction.

High Ratios and Asset Debasement

When the Fed engages in monetary expansion, such as through quantitative easing, the balance sheet swells with asset purchases. If, during this period, the ratio increases, it implies that the asset is not appreciating as rapidly as the money supply. This could indicate an underperformance, potentially signaling a loss of value or a lack of confidence among investors. Assets that fail to keep pace might be seen as less effective stores of value, effectively becoming debased against a burgeoning supply of currency.

Low Ratios and Asset Appreciation

On the flip side, if the Fed’s balance sheet grows but the ratio decreases, it signals that the asset is outperforming the pace of monetary expansion. This outpacing can often be read as a sign of strong demand or a collective assessment of the asset as a better store of value. As investors flock to these assets, they may serve as a hedge against currency debasement, retaining or increasing their purchasing power even as more money enters circulation.

Correlation and Causation: A Critical Distinction

While these trends offer insights, they should not be viewed in isolation. Correlation between the Fed’s balance sheet and asset values does not exclusively establish causation. Market dynamics are influenced by a plethora of additional factors, including but not limited to, global economic conditions, investor sentiment, market liquidity (driven in-part by Central Banks Balance Sheets), and geopolitical events. Therefore, a comprehensive analysis must consider these complexities to understand fully the underpinnings of any movements.

In conclusion, the Fed/Asset Ratios serve as a diagnostic tool, a financial canary in the coal mine. They provide snapshots of how assets are faring in the broader economic narrative. While a higher ratio could spell concern for an asset’s ability to maintain value in the face of an inflating money supply, a lower ratio might herald its relative strength and appeal as a hedge against debasement.

Assets YoY against the Federal Balance Sheet YoY

When analyzing the Year-over-Year (YoY) change rates of different assets, especially in relation to the Federal Reserve’s balance sheet, it’s essential to grasp how these assets are performing in the context of changes in the money supply or fiscal actions by the Federal Reserve.

Case of Negative Balance Sheet Change: Monetary Tightening Indicator

- When the Federal Balance Sheet shows a negative YoY change, such as -14.03%, it indicates a contraction in the balance sheet. This contraction can be seen as a form of monetary tightening or a reduction in the liquidity provided by the Federal Reserve.

- If, during this period, an asset like Bitcoin experiences a significant positive YoY change, for example, 138.14%, it suggests that Bitcoin is appreciating in value at a much faster pace compared to the rate of change in the Federal Balance Sheet. In this scenario, Bitcoin is considered to be outperforming, potentially viewed as a hedge against what might be perceived as currency debasement when the balance sheet is expanding.

Case of Slight Positive Balance Sheet Change: Negligible Currency Debasement

Conversely, if the Federal Balance Sheet’s YoY change is slightly positive, say 0.0576%, indicating a minor expansion, and Bitcoin’s YoY change is negative, such as -7.14%, then Bitcoin is not just failing to outperform but is also depreciating in value during a period of very slight or negligible currency debasement.

Calculating Outperformance or Underperformance

- To quantify how much an asset like Bitcoin is outperforming or underperforming relative to the currency debasement (or contraction), you can directly compare the percentage changes. For instance, if the balance sheet change is -14.03% and Bitcoin’s change is +138.14%, Bitcoin is outperforming the balance sheet change by (138.14% – (-14.03%)) = 152.17%.

- If the balance sheet change is +0.0576% and Bitcoin’s change is -7.1397%, Bitcoin is underperforming by (-7.1397% – 0.0576%) = -7.1973%.

Visualise Past Debasement Hedging Options

visualize the performance of various assets relative to the Federal Balance Sheet. Each asset’s performance is indexed to its value starting from October 2008 – where possible.

How it displays assets that are outperforming the Federal Balance Sheet debasement:

Indexed Series: The script normalizes each asset’s value by indexing them to a base value of 100, which represents their value on the first date with data available for each asset after October 2008.

Line Chart: The normalized values for each asset and the Federal Balance Sheet are plotted on a line chart, where the x-axis represents time (date), and the y-axis represents the indexed value.

Comparison: By examining the chart, you can visually compare the performance of different assets against the Federal Balance Sheet. An asset is considered to be outperforming if its line rises below (usually -x) the line of the Federal Balance Sheet, showing greater growth relative to its own starting value. If an asset’s line rises faster or higher than the line representing the Federal Balance Sheet, it suggests that the asset is appreciating more quickly than the growth or expansion of the Federal Reserve’s balance sheet.

Interpretation: For instance, if the ‘BTC-USD’ line climbs lower (higher) than the ‘Value’ line (which represents the Federal Balance Sheet), it means Bitcoin’s indexed value has increased more compared to the Federal Balance Sheet since the base date. This indicates that Bitcoin is outperforming the debasement of the dollar as executed by the Federal Reserve’s balance sheet expansion.

In summary, the chart is a straightforward visual comparison. Assets above the Federal Balance Sheet line are outperforming its expansion, while those below are underperforming. Keep in mind that if an asset does not have data for October 2008, its line will begin at the first available data point after that date, and its indexed value at that starting point will be 100.